Hello everyone! Today, we want to talk about something that is relevant to many of us - the W-9 form. Whether you’re a freelancer, independent contractor, or a business owner who hires contractors, the W-9 form is an essential document that you may have come across in your professional life.

What is a W-9 form?

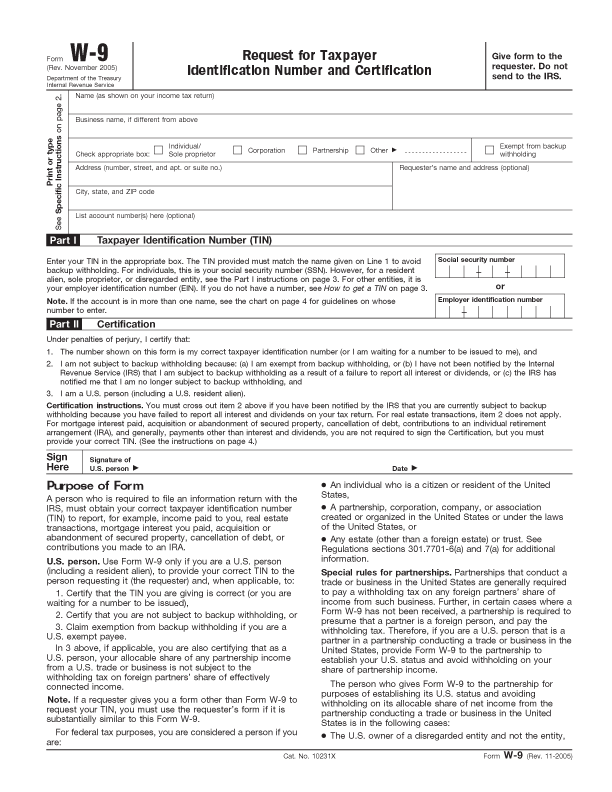

A W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by businesses to gather information from independent contractors or service providers. It is essential for tax purposes and helps businesses report the amounts they pay to the contractors to the Internal Revenue Service (IRS).

The W-9 form consists of several fields where contractors provide their personal information, including their name, address, Social Security Number (SSN), or Employer Identification Number (EIN). This form ensures that the business has the necessary information required to accurately report payments made to the contractors and issue Form 1099-MISC at the end of the year.

The W-9 form consists of several fields where contractors provide their personal information, including their name, address, Social Security Number (SSN), or Employer Identification Number (EIN). This form ensures that the business has the necessary information required to accurately report payments made to the contractors and issue Form 1099-MISC at the end of the year.

Why is the W-9 form important?

The W-9 form is crucial for both businesses and contractors. For businesses, it allows them to fulfill their tax obligations and ensure compliance with IRS regulations. By collecting the necessary information upfront, businesses can avoid potential penalties for not reporting payments correctly.

For contractors, completing the W-9 form accurately is essential as it determines how they will be categorized for tax purposes. It influences whether they will be classified as employees or independent contractors. Additionally, the form helps businesses determine whether they need to withhold taxes from payments made to the contractors.

It’s important for contractors to understand the distinction between being an employee and an independent contractor. Employees receive a Form W-2, which reports their wages and taxes withheld, while independent contractors receive a Form 1099-MISC, which reports the total payments received from businesses throughout the year.

It’s important for contractors to understand the distinction between being an employee and an independent contractor. Employees receive a Form W-2, which reports their wages and taxes withheld, while independent contractors receive a Form 1099-MISC, which reports the total payments received from businesses throughout the year.

If you’re a contractor and unsure about your classification, the W-9 form can serve as a helpful reference point. It’s always a good idea to consult with a tax professional or the IRS guidelines to ensure you understand your tax obligations correctly.

Where can you find a W-9 form?

Now that we understand the importance of the W-9 form, let’s discuss where you can find it. Luckily, there are several options available:

- One common option is to visit the official IRS website. They provide the most up-to-date version of the W-9 form, along with instructions on how to fill it out correctly.

- Another convenient option is to use online platforms like PDFFormPro or PDFfiller. They offer editable and printable versions of the W-9 form, making it easier for contractors to complete and submit.

- If you prefer a physical copy, you can find printable versions of the W-9 form at various online sources like Free Printable W9 or Prime Power LLC. These sources provide downloadable PDFs that you can print and fill out manually.

Remember, when using online platforms to access the W-9 form, ensure that you use reputable and secure websites to protect your personal information.

Remember, when using online platforms to access the W-9 form, ensure that you use reputable and secure websites to protect your personal information.

In conclusion

The W-9 form is a vital document for businesses and contractors alike. It ensures proper reporting of payments made to contractors and helps determine the tax obligations of both parties. Make sure to complete the W-9 form accurately and keep a copy for your records.

If you’re ever unsure about any aspect of the W-9 form or your tax obligations, consult with a tax professional or refer to the official IRS guidelines. Stay informed, fulfill your tax responsibilities, and keep your professional life organized!