As we navigate through the complexities of the tax season, it is essential for all working individuals to have a thorough understanding of the IRS Form W-4. This form plays a significant role in determining the amount of income tax that is withheld from your paycheck. To make your life a little easier, we have compiled a collection of informative resources and printable versions of the W-4 form for the year 2020.

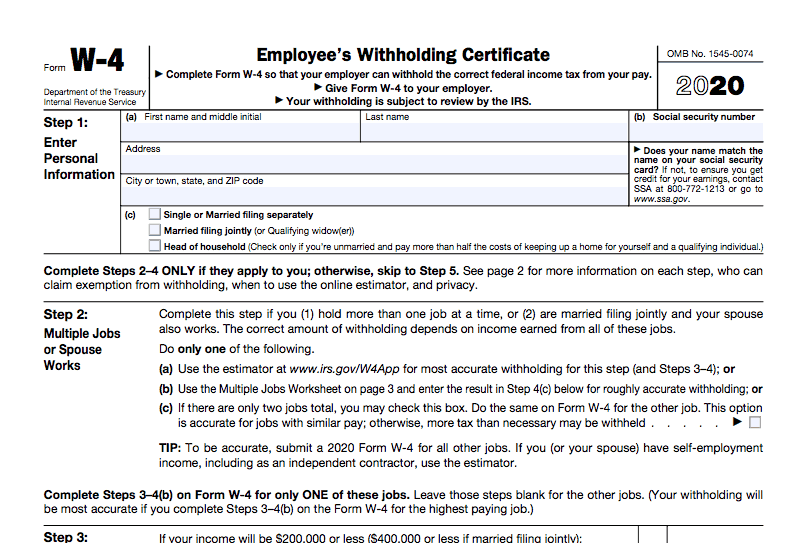

W 4 Printable 2020 | W4 2020 Form Printable

W 4 Printable 2020 | W4 2020 Form Printable

Starting off our collection is the W 4 Printable 2020 version. This resource is invaluable for employees who need to update their tax withholding information. By providing concise and easy-to-understand instructions, this printable form simplifies the process of accurately completing your W-4.

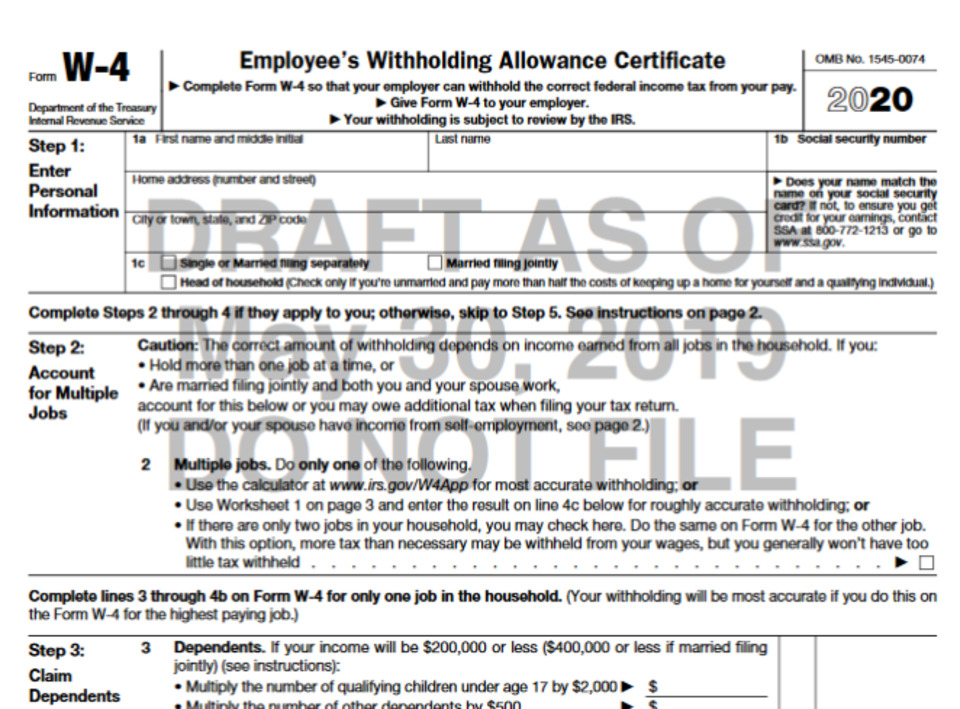

Printable W 4 Form Payroll - 2022 W4 Form

Printable W 4 Form Payroll - 2022 W4 Form

Next, we have the Printable W 4 Form Payroll edition, specifically designed for businesses and payroll departments. This form provides employers with a comprehensive layout to effectively manage the W-4 forms of their newly hired employees. It saves time and ensures that all necessary information is captured accurately.

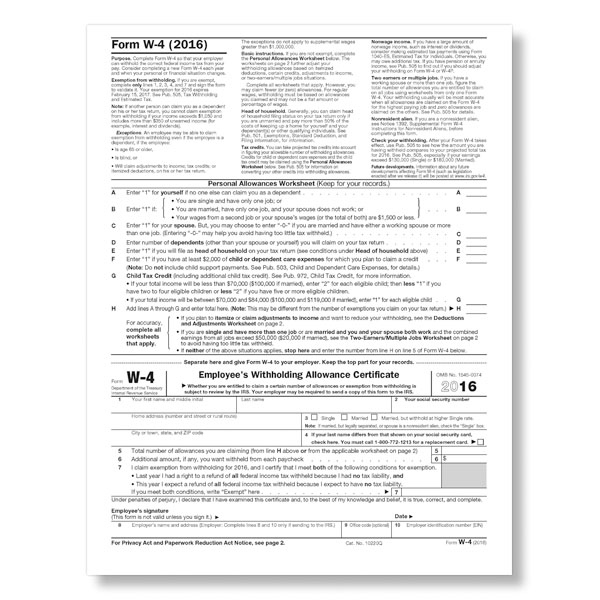

Treasury and IRS unveil new Form W-4 for 2020 | Accounting Today

Treasury and IRS unveil new Form W-4 for 2020 | Accounting Today

In an effort to keep taxpayers informed, the Treasury and IRS collaborated to introduce the new Form W-4 for the year 2020. This version reflects recent changes in tax laws and ensures accurate withholding of taxes. The collaboration between these entities highlights the commitment to provide individuals with up-to-date and relevant tax information.

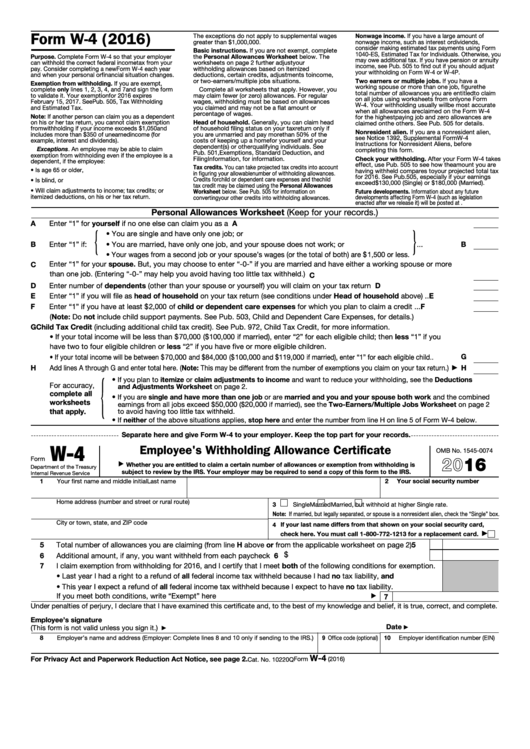

2020 Federal W4 Printable Form - 2022 W4 Form

2020 Federal W4 Printable Form - 2022 W4 Form

If you are looking for an official resource straight from the IRS, the 2020 Federal W4 Printable Form is the perfect choice. This form is specifically designed to meet the unique requirements of federal income tax withholding. It simplifies the process for both employers and employees, ensuring that the correct amount is withheld according to the most recent tax regulations.

A New Form W-4 for 2020 - Alloy Silverstein

A New Form W-4 for 2020 - Alloy Silverstein

As Alloy Silverstein explains, the new Form W-4 for 2020 was introduced by the IRS to align with the federal tax law changes. This updated form provides employees with a clear and straightforward method of calculating their tax withholding. It takes into account various factors such as dependents, deductions, and additional income, ensuring an accurate and personalized tax withholding amount.

W4 Form Example For Single 2023 - W-4 Forms - Zrivo

W4 Form Example For Single 2023 - W-4 Forms - Zrivo

If you are a single individual seeking a W-4 form example, the W4 Form Example For Single 2023 from Zrivo is a valuable resource. This example demonstrates how to fill out the W-4 form for optimal tax withholding for single employees without any dependents. It guides you through each section step-by-step to ensure accurate completion.

Fillable W-4 Form - 2022 W4 Form

Fillable W-4 Form - 2022 W4 Form

A convenient option for individuals who prefer to complete forms digitally, the Fillable W-4 Form is available for the year 2022. It allows you to fill in the necessary information online before printing out the completed form. This interactive form eliminates the hassle of handwriting and ensures legibility.

New Form W-4 : What Employers Need to Know - Dembo Jones Certified

New Form W-4 : What Employers Need to Know - Dembo Jones Certified

Dembo Jones Certified provides valuable insights into the new Form W-4 and the implications it has for employers. The informative article sheds light on the updates and changes to the form, discussing how employers should handle the transition. It provides employers with a clear understanding of their responsibilities and ensures compliance.

W4 2020 Form Printable IRS - 2022 W4 Form

W4 2020 Form Printable IRS - 2022 W4 Form

The W4 2020 Form Printable IRS edition provides employers with a comprehensive overview of the new form and its implications. It outlines the changes made to the W-4 form and the impact these changes have on businesses. This resource is highly beneficial for employers who need to update their payroll processes accordingly.

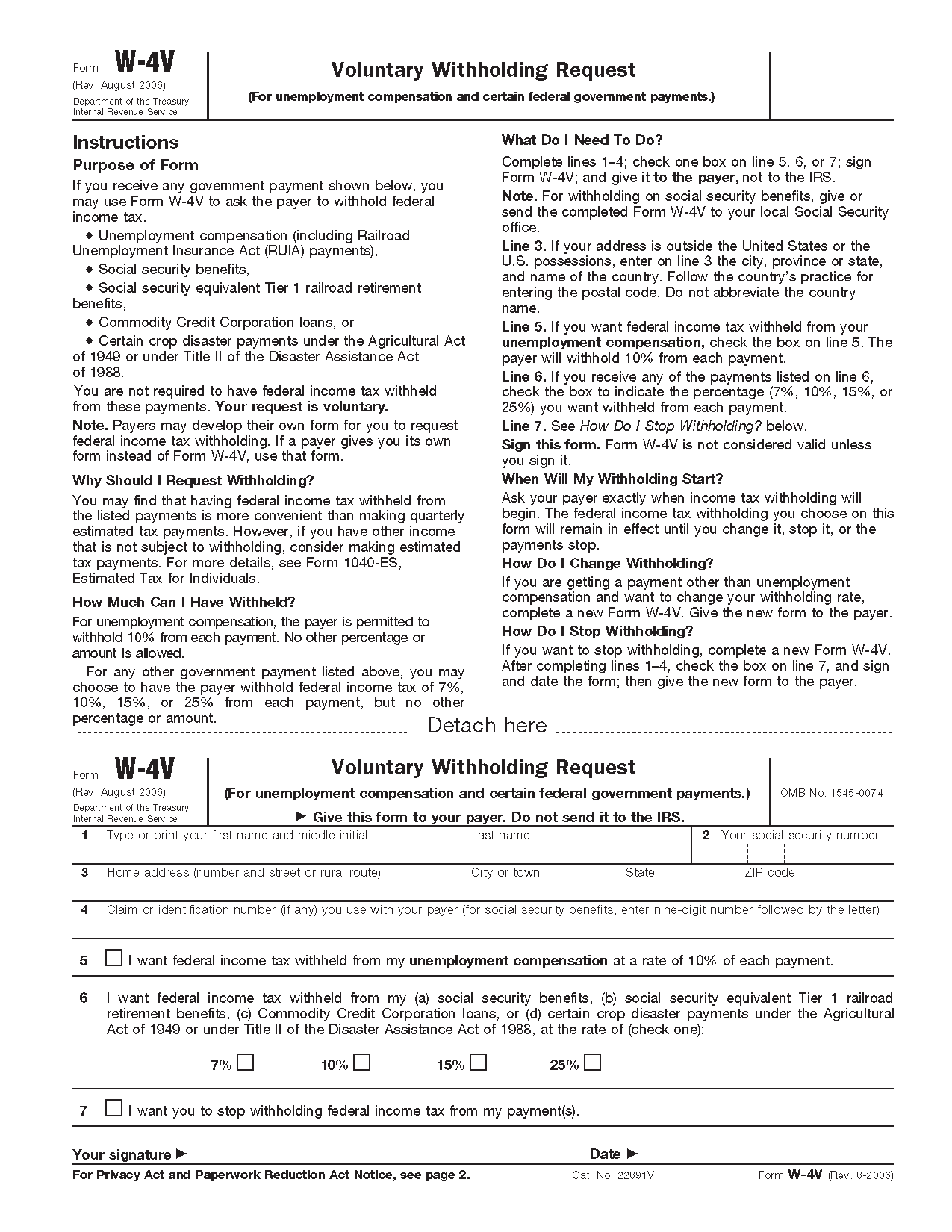

IRS Form W 4V 2021 Printable - 2022 W4 Form

IRS Form W 4V 2021 Printable - 2022 W4 Form

To cater to individuals who require access to the IRS Form W 4V, the 2021 printable version is readily available. This particular form is designed for those individuals who receive certain federal payments, such as a pension or annuity, and need to make voluntary withholding requests. It simplifies the process and ensures the correct amount is withheld.

With the help of these resources, you can navigate the process of completing and understanding the IRS Form W-4 with ease. Whether you are an employee, employer, or simply an individual seeking clarity on tax withholding, these printable forms and informative articles provide valuable guidance. Remember, accurate completion of the W-4 form is crucial to avoid any surprises when it comes to your income tax withholding.