Hey there! Are you a small business owner? Looking for information on IRS Form 1099 reporting? Well, you’re in luck! We’ve got some great resources and free printable forms to help you out. Let’s dive in!

Irs Form 1099 Reporting For Small Business Owners - Free Printable 1099

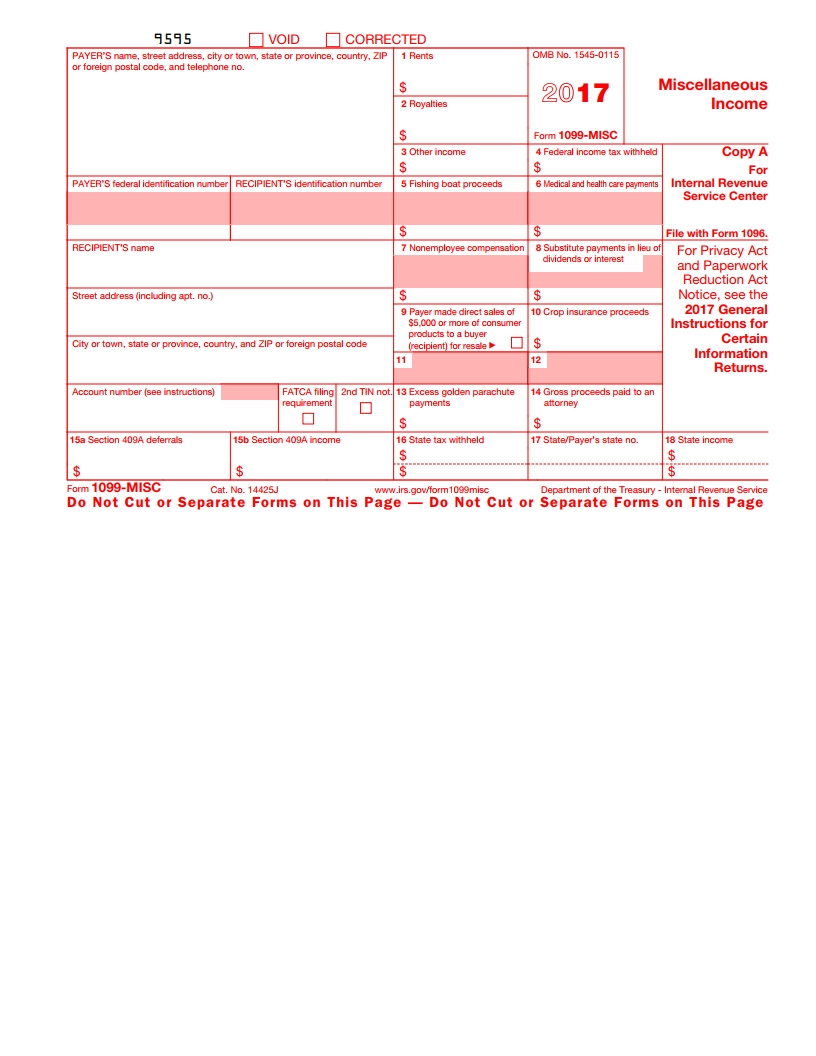

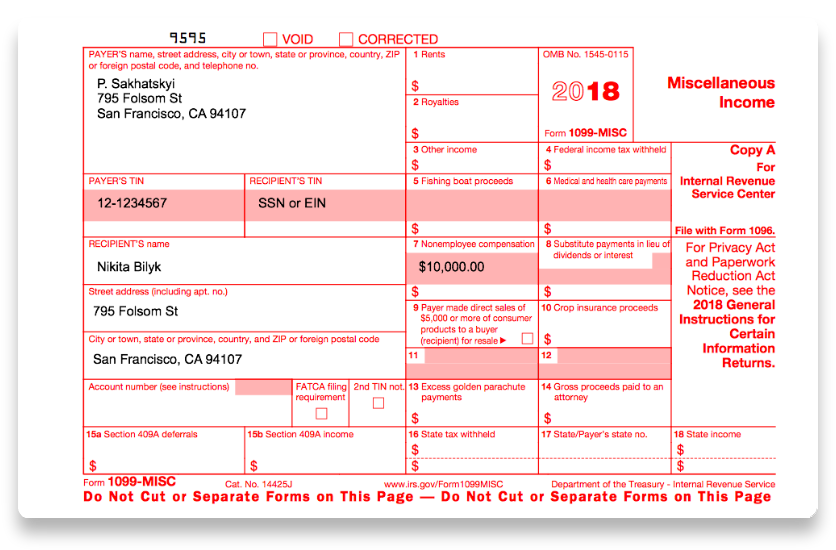

One of the essential forms for small business owners is the IRS Form 1099. This form is used to report income earned by individuals who are not traditional employees. It is commonly used to report payments made to independent contractors, freelancers, and other non-employees. If you’ve hired independent contractors for your business, you’ll need to familiarize yourself with this form.

One of the essential forms for small business owners is the IRS Form 1099. This form is used to report income earned by individuals who are not traditional employees. It is commonly used to report payments made to independent contractors, freelancers, and other non-employees. If you’ve hired independent contractors for your business, you’ll need to familiarize yourself with this form.

1099 Tax Form Independent Contractor | Universal Network

As a small business owner, it’s crucial to understand your tax obligations when you hire independent contractors. The 1099 Tax Form is specifically designed for reporting payments made to independent contractors. It provides the necessary information to the IRS and helps contractors with their own tax reporting. Make sure you have a clear understanding of this form to avoid any tax-related issues.

As a small business owner, it’s crucial to understand your tax obligations when you hire independent contractors. The 1099 Tax Form is specifically designed for reporting payments made to independent contractors. It provides the necessary information to the IRS and helps contractors with their own tax reporting. Make sure you have a clear understanding of this form to avoid any tax-related issues.

Free 1099 Form Independent Contractor - Form : Resume Examples #l6YNp6o23z

If you’re looking for a free 1099 Form for independent contractors, look no further! We have a printable template that you can download, fill, and print. This template simplifies the process of reporting payments made to independent contractors and ensures that you’re compliant with IRS regulations. Don’t let the complexity of tax forms stress you out; our free form is here to make your life easier!

If you’re looking for a free 1099 Form for independent contractors, look no further! We have a printable template that you can download, fill, and print. This template simplifies the process of reporting payments made to independent contractors and ensures that you’re compliant with IRS regulations. Don’t let the complexity of tax forms stress you out; our free form is here to make your life easier!

1099 Form Independent Contractor Pdf - 1099 Form Independent Contractor

If you prefer a PDF version of the 1099 Form for independent contractors, we’ve got you covered. Our PDF form is easy to fill out, save, and print. Whether you’re filing taxes electronically or sending paper copies to the IRS and contractors, our PDF form is a convenient option.

If you prefer a PDF version of the 1099 Form for independent contractors, we’ve got you covered. Our PDF form is easy to fill out, save, and print. Whether you’re filing taxes electronically or sending paper copies to the IRS and contractors, our PDF form is a convenient option.

1099 Form Independent Contractor Pdf : Irs 1099 Misc Form Free Download

Need to download the IRS 1099 Misc form for free? We’ve got you covered! Our website offers a free download of the 1099 Form, making it easy for you to access and fill out the required information. Simplify your tax reporting process with our free download now!

Need to download the IRS 1099 Misc form for free? We’ve got you covered! Our website offers a free download of the 1099 Form, making it easy for you to access and fill out the required information. Simplify your tax reporting process with our free download now!

15 Printable 1099 form independent contractor Templates - Fillable

Looking for various templates for the 1099 form? We have 15 printable and fillable templates available for you to choose from. Whether you need a template for a specific industry or want a general template, we have options that cater to your unique needs. Save time and effort by utilizing our fillable templates!

Looking for various templates for the 1099 form? We have 15 printable and fillable templates available for you to choose from. Whether you need a template for a specific industry or want a general template, we have options that cater to your unique needs. Save time and effort by utilizing our fillable templates!

1099 Form Independent Contractor Pdf - FREE 10+ Sample Independent

Are you unsure of how to fill out the 1099 Form for independent contractors? Don’t worry; we have a step-by-step guide to help you out. Our sample forms illustrate the required fields and provide examples of how to correctly report payments made to independent contractors. Say goodbye to confusion and ensure accurate reporting with our free samples!

Are you unsure of how to fill out the 1099 Form for independent contractors? Don’t worry; we have a step-by-step guide to help you out. Our sample forms illustrate the required fields and provide examples of how to correctly report payments made to independent contractors. Say goodbye to confusion and ensure accurate reporting with our free samples!

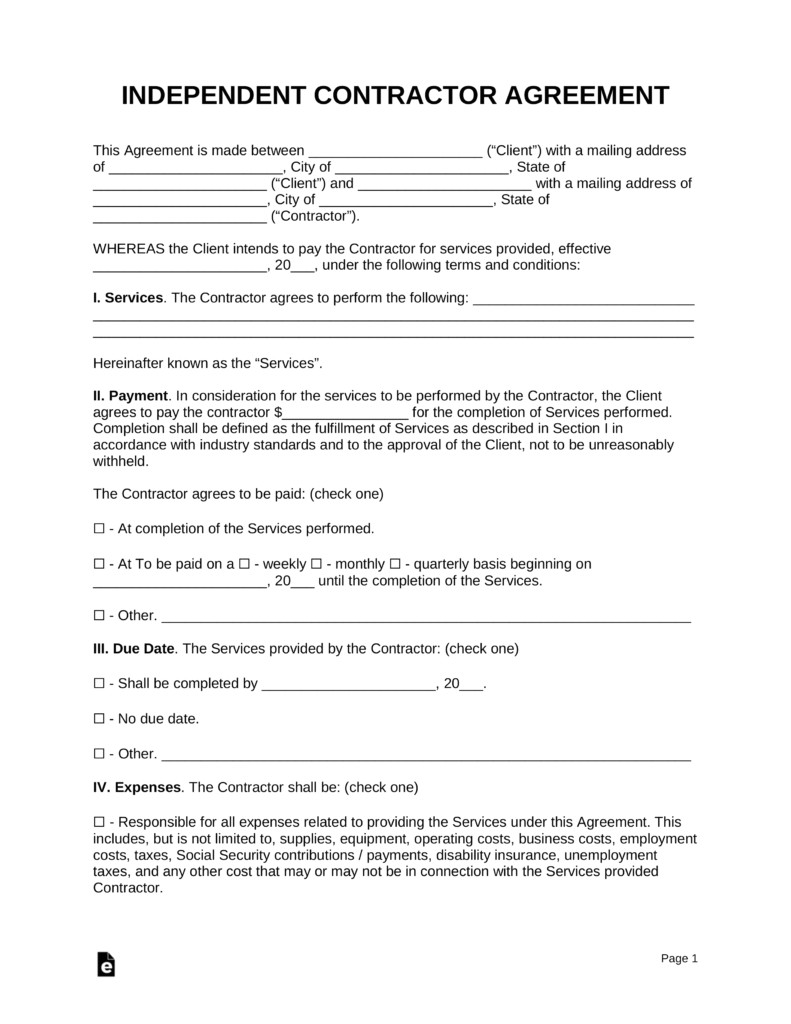

1099 Employee Contract Template | williamson-ga.us

When hiring independent contractors, it’s essential to have a clear agreement in place. Our 1099 Employee Contract Template is designed to help you outline the terms and conditions of your working relationship with contractors. By using this template, you can establish expectations, protect your business interests, and maintain compliance with relevant laws and regulations.

When hiring independent contractors, it’s essential to have a clear agreement in place. Our 1099 Employee Contract Template is designed to help you outline the terms and conditions of your working relationship with contractors. By using this template, you can establish expectations, protect your business interests, and maintain compliance with relevant laws and regulations.

Fast Answers About 1099 Forms for Independent Workers - Small Business

If you have questions about 1099 forms for independent workers, we’ve got you covered! Check out our fast answers guide, specifically tailored for small business owners. We address common concerns and provide clear explanations to help you navigate the world of independent contractor reporting. Stay informed and compliant with our comprehensive guide!

If you have questions about 1099 forms for independent workers, we’ve got you covered! Check out our fast answers guide, specifically tailored for small business owners. We address common concerns and provide clear explanations to help you navigate the world of independent contractor reporting. Stay informed and compliant with our comprehensive guide!

1099 Form Independent Contractor Pdf / Form 1099 is a type of

Form 1099 is a type of tax form used to report various types of income other than regular wages, salaries, and tips. It is essential for independent contractors, freelancers, and other self-employed individuals to understand this form. Our website provides valuable resources and information on Form 1099, ensuring that you fulfill your tax obligations correctly.

That’s a wrap on our comprehensive guide to IRS Form 1099 reporting for small business owners. We hope you found this information helpful and that it simplifies your tax reporting process. Remember, it’s crucial to stay informed and compliant with IRS regulations when it comes to reporting payments made to independent contractors. If you have any questions, feel free to reach out to us. Happy reporting!